How To Find The Ideal Condo For Investment?

How To Find The Ideal Condo For Investment?

The GTA has always been one of the most desirable locations for investments. If you want to invest in a condo, you need to factor in different elements, from costs to profitability potential. The GTA may have a lot of investment potential, but make sure to avoid speculating and stick to rational methods. Research, investigate and learn how the market works before you invest. Here are several things to consider before making any sudden moves.

Financing

If you count on a mortgage just like most investors to finance your condo investment, make sure you understand that it will be different from when taking out a mortgage for your first home. You will need a minimum down payment of 20% for your condo investment. That means that you will need to have a considerable amount of money sitting in your bank account to qualify for a mortgage on a second home in your name. You will need to know how much money the bank will lend you based on your downpayment, credit history, employment income etc.

Location

Location is the most important thing when investing in Real Estate. So make sure you study the neighbourhood, factor in things such as:

a) is the condo in an affluent area?

b) is this community being revitalized?

c) future LRT/subway lines coming up? Other transportation in the neighbourhood?

d) future developments in the area that may help the price point increase?

e) popular community, ie. Liberty Village, Cityplace, King West, etc.

f) Lakeview condos

Price

If you are buying a condo, you need to decide whether you want to buy a pre-construction condo or an existing condo. If you are buying an existing condo, check the last few sold in the building and immediate neighbourhood for the same size units and year of construction. If you are buying a pre-construction condo, you can expect to pay more for it then existing condos in the neighbourhood, and you will pay extra closing costs in the end. No rule of thumb say's a gap of existing vs pre-construction should be X amount, but you should evaluate it and see if it makes sense to you by the time of completion.

What Are Renters Looking For?

As a condo investor, you have to think from the renter's perspective. What would you look for in a rental? Focusing on location, condition, size, and surrounding amenities is a good start. The second step is to figure out what kind of renter profile you want to target. If you are looking to buy a condo in the downtown area, you will probably want to attract young professionals who find the convenient downtown lifestyle appealing. This means you should look for a smaller one or two-bedroom units as young professionals either live alone or take a roommate. If you are targeting bigger units, your ideal renter would be a family, and they usually prefer quieter areas and condos close to schools and parks. Finding a condo close to public transit, universities, and parks is always a win, so consider the entire surrounding before making a final decision.

Another important thing, especially if you have a limited budget, is to keep an eye on up-and-coming neighbourhoods known to appreciate very fast after a couple of years. The only catch is to figure out which communities have an enormous potential to become the next place. You can do that by finding out if any malls and facilities like gyms and schools are going to be built in the area, if any restaurants and shops are planned, etc. These are indicators that the neighbourhood will grow quickly and attract a high number of new residents.

Resale Value

Last but not least, at some point, you need to sell this condo. Do you think by the time you are thinking of selling this condo, there will be enough demand for this type of property in the neighbourhood? Ie. 400 Sq. Ft. in Downtown can sell quite quickly, but maybe not so much in the suburbs.

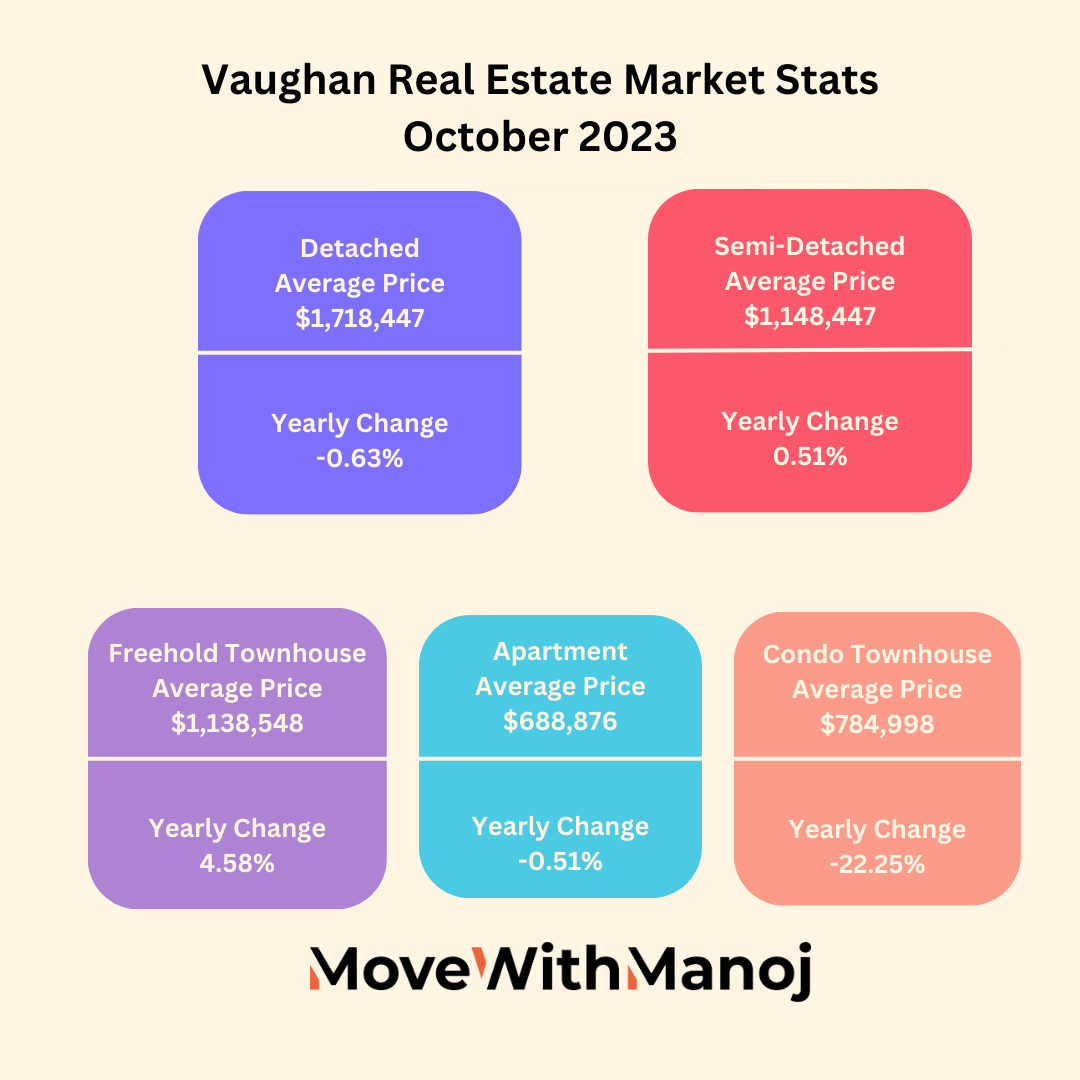

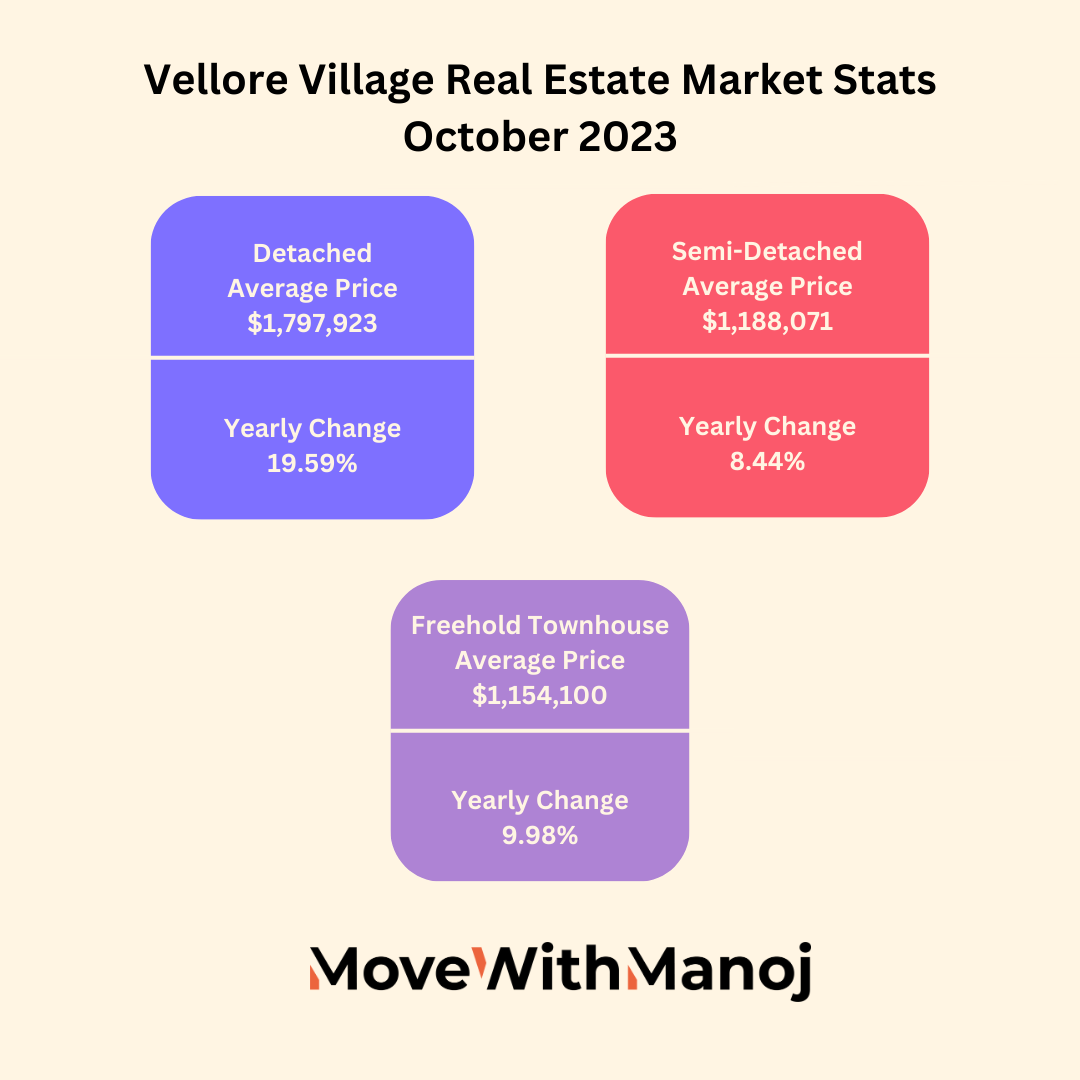

When it comes to the GTA, Toronto, Mississauga, Brampton and Vaughan are high-in-demand areas for investment, and if you would like to explore these particular areas and find the right investment condo for you, feel free to give me a call.

Comments