PREPARE FOR HOME SHOPPING

Thinking About Buying A House This Summer? Start Preparing Now

If you are planning to buy a home in the summer, it would be good to get some things done before you start looking. It takes a lot more to shop for a house than browsing online and going to showings. Planning will help you a great deal later when it’s time to sign the contract. Saving for the down payment, checking your credit report and getting a pre-approval are all parts of the prep work.

Saving for the down payment

Even if it’s true that a 5% down payment can get you a mortgage, it’s far better to come up with more. Bigger down payments will work in your favour in multiple ways. First of all, lenders will be more willing to take you as a serious candidate, and second, the CHMC insurance and interest rates will be lower, which saves money in the long run. Since the introduction of the new mortgage stress tests, lenders have become more careful in their selection process, which means you need every advantage you can get. The more money you lay aside for a down payment, the smaller your mortgage balance. It’s never too early to start saving for it.

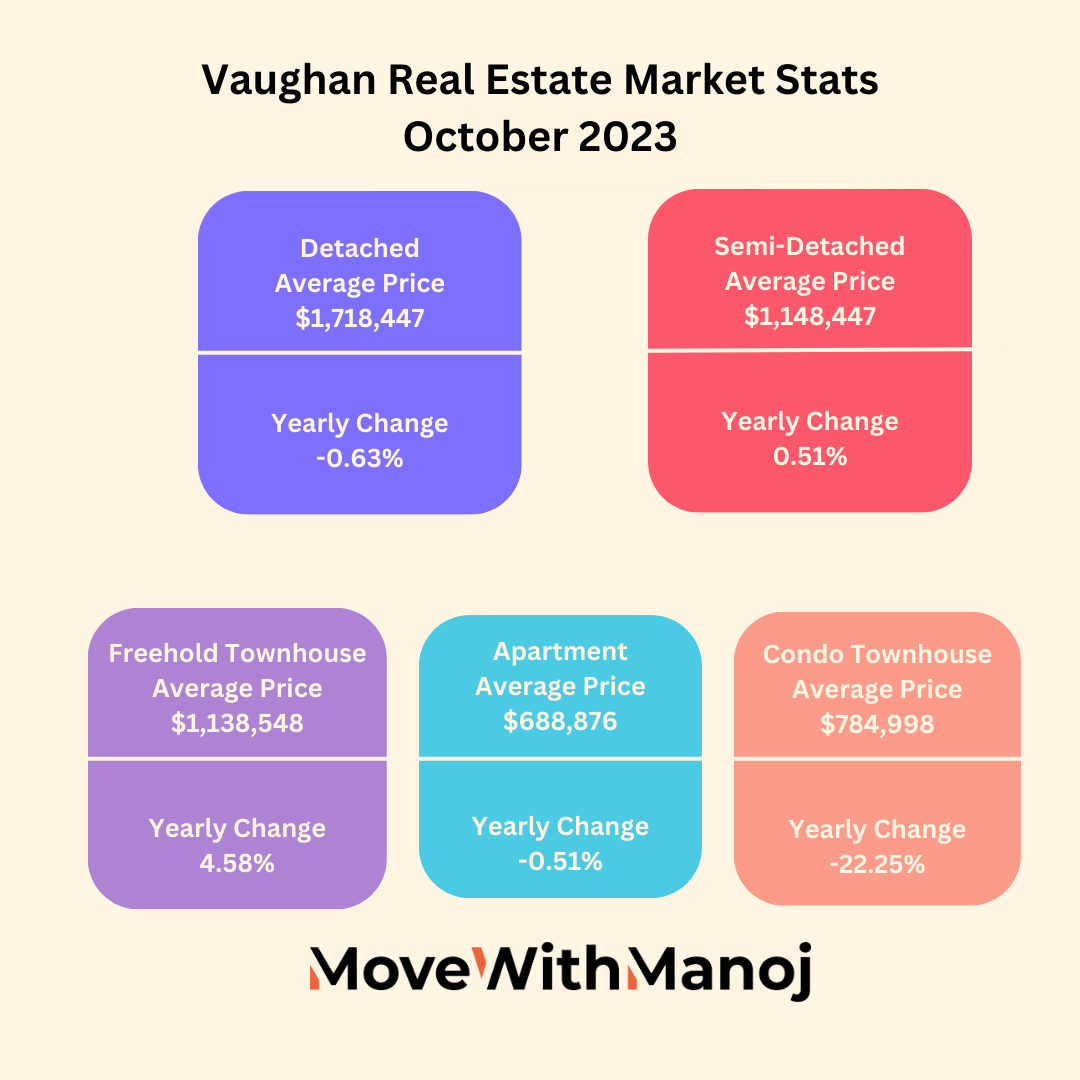

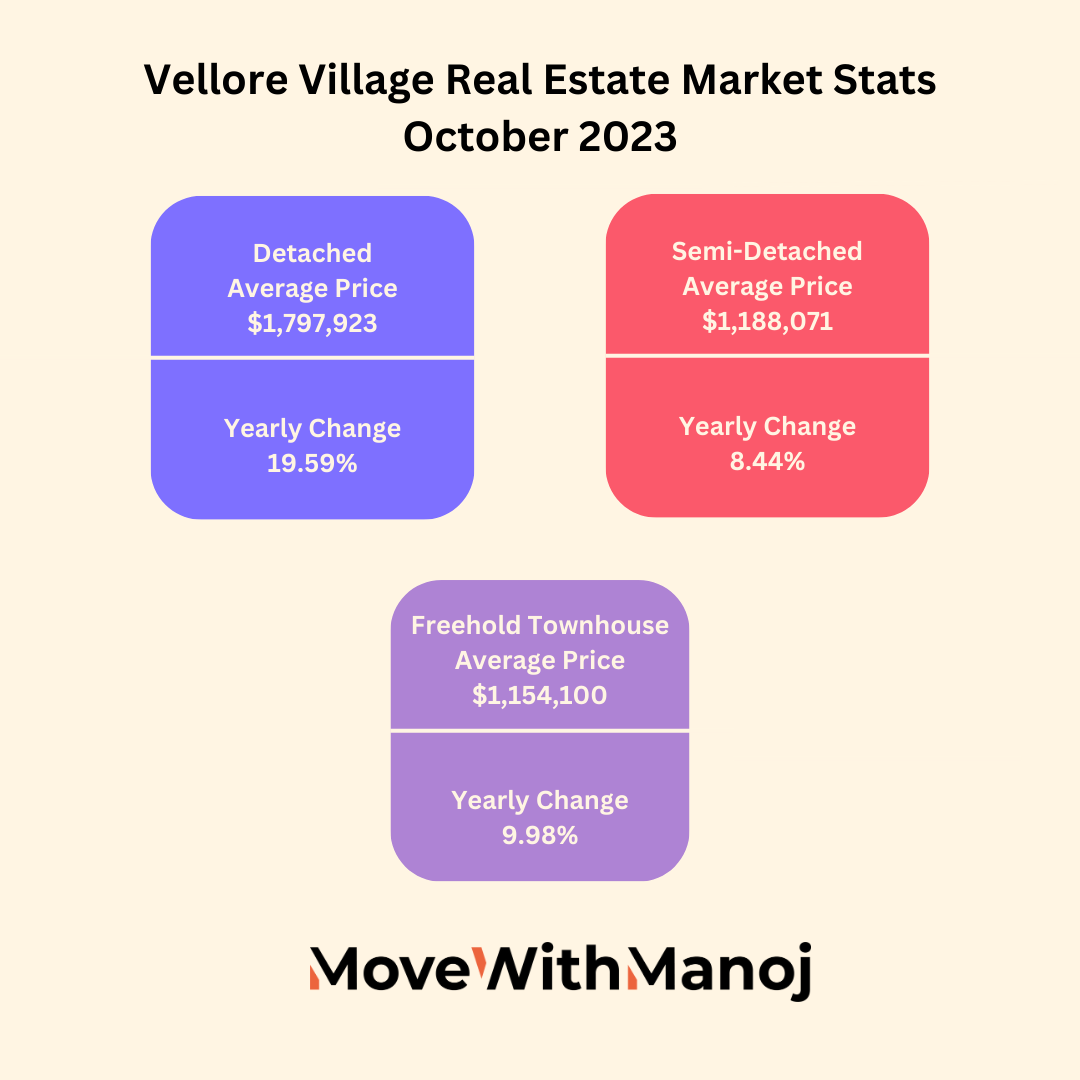

Research the real estate market

The real estate market is not fixed, and prices differ from season to season and from community to community. You need to know how much house you can get and where for the money you have. Which location seems to fit you, but is not over your budget? Are you willing to pay more for a good location, even if it might not be in top condition? Explore neighbourhoods to find out which street suits you and show up at open houses sometimes to get an idea of the differences between online ads and homes in reality.

Credit report

You should request a credit report before the lender does. Credit reports are not always accurate, giving you time to report any mistakes and slips made in your report. The lender must get an updated and correct version when you apply for a pre-approval.

Talk to lenders

Gather information from all relevant parties, including the lenders’ office. Make sure you know what awaits you when you apply for a mortgage and what will be taken into consideration. The lender can tell you how your credit report will impact the mortgage. If your debt to income ratio is not satisfying, it can result in higher interest rates. It’s essential to know these things in advance, so you can start working on reducing your debt and increasing your odds with the lender when it comes to applying for a mortgage.

Start looking for an agent.

One may think that an agent can be found on every corner, but you’ll have to dig deep to find a good one. Agent shopping is not that uncommon anymore, and you have the right to interview as many as you want until you make your decision. Focus on their references, experience and input before you pick one.

Comments