Switching From Renting To Homeownership: What Do You Need To Know?

It is always exciting to switch from the tenant lifestyle to having your very own property, regardless of whether you are buying a detached or small condo. Having your own home is mainly associated with a feeling of liberation and freedom. It is truly a special moment for each homebuyer, but it also brings a dynamic to your life that is different from being a tenant, so here is a list of a few things that change once you switch from renting to owning.

You will have more freedom but also more responsibilities.

Owning a home is great because you can remodel, upgrade and decorate it to your own taste without any restrictions. There is more room for you to add a personal touch to the place that reflects your lifestyle. However, you will also now be responsible for everything inside your new home, which means if the washing machine breaks, you will have to find a handyperson to fix it and pay for the service yourself as there is no landlord anymore to take care of it.

You’ll earn in equity, but initial costs might be a bit higher than the average rent.

While renting only means paying the monthly rent and bills, being a homeowner means paying property taxes, closing costs (until the sale is through) and maintenance costs on top of monthly mortgage payments (unless you bought the home with cash). Buying a home is not a small investment, but it is probably one of the smartest investments to make. With the years, the more mortgage you pay off, the more you’ll earn in equity. With renting, you are only giving lots of money on a monthly basis without getting anything in return. Paying off your mortgage (even when it is higher than a month’s rent) gives you so much in return- your own property that you can later sell, keep or turn into a rental if you want. Owning a home is highly associated with a safer future and makes homebuyers feel financially more secure.

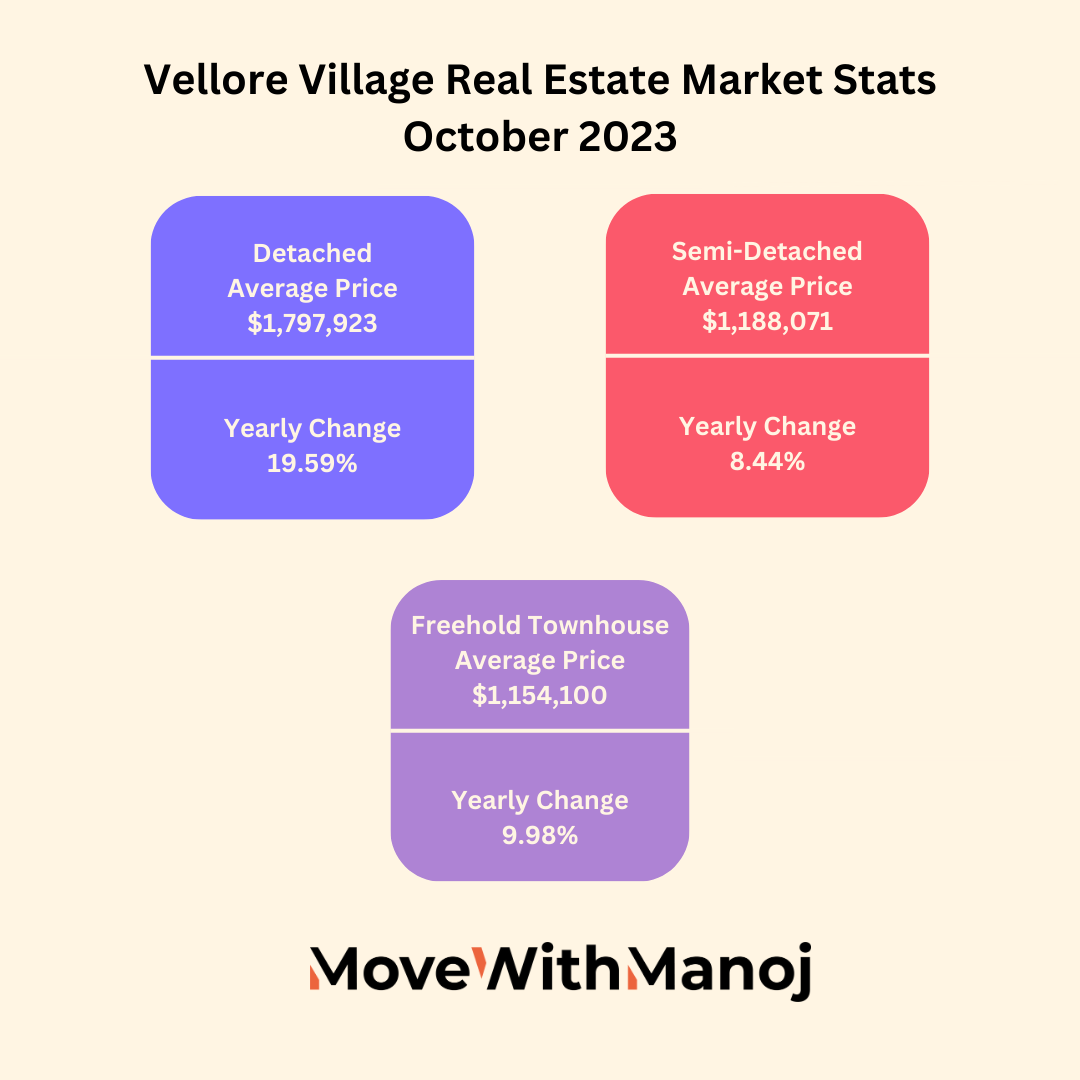

Your property is likely to appreciate in value with time.

Homes and properties tend to appreciate in value over the years. If we look back at the past decade, we can see that homes in the GTA have significantly increased in value, and the trend is probably going to grow further. This means that if you decide to sell your house in 10, 15 or 20 years, you will probably be able to sell it for more than what you bought it for, which is a great thing. As well, new construction condos are increasing in value especially fast.

As a fresh homeowner, you can hope that your home will generate some extra profit one day if you decide to sell, while renters are probably worrying about the rent going up and what options they will have if it happens.

Owning a home is still one of the top priorities for GTA residents who are currently renters, and if you are also one of them, make sure to give me a call (647) 370 – 0992 to discuss your current or future real estate needs. You may not be ready to buy today, but you may be prepared to buy some day, so contact me if you have any questions.

Comments