Why you Should Invest in Condos?

Investing in Condos

Investing in Condos is very easy within the GTA and becoming a popular choice for many savvy investors. It yields a far higher return than any other type of investment out there with minimal headaches.

Contents

Is Investing in Condos still a good idea?What are the benefits of Investing in a Condo?

What are the downsides of investing in a condo?

Condos Vs Stocks?

Why did you choose the TSX vs any other Mutual Fund?

If you have been waiting around, you are missing out on some astonishing growth. Think about it if you can go back to January of 2015 and get a 1-bedroom condo in Toronto for $329,659, would you? That was the average price of a 1 Bedroom Condo in 2015, and in January of 2020, it is worth $582, 259. That means a one-bedroom condo has increased by $252,600, a cumulative growth rate of 76.62% and an average of 15.32% per year. I am not even factoring in that your mortgage has decreased in value at this point, and you only put down 20% ($66,000) plus closing costs to purchase this condo.

Now we all know past returns are not an indicator of future outcomes. Considering COVID 19 started in March of 2020, there has to be some negative impact in the Toronto real estate market. I am sure there will be, so I will update this article and the figures in it in September 2020 and continue to update this article every 3 to 6 months. If you are a Savvy investor, you need to take this as an opportunity to buy. Warren Buffet’s investing style would recommend, “We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.” Meaning when the markets are down and chaotic, that’s the right time to invest, and when everyone is jumping into the market, it’s an excellent time to get out.

Is investing in Condos still a good option?

My answer is Yes! I don’t have a crystal ball, but I still think investing in Condos is an excellent option and here are some reason why;

- We have over 130,000 immigrants coming to Ontario every year

- According to Stats Canada, Ontario’s current population as of 2019 is 14.5 million and expected to grow to 16.70 million by 2025. That’s an extra 2.2 million people coming to Ontario within the next six years.

- Toronto is Canada’s Economic Driving Force, and Toronto is the second-largest financial centre in North America.

- Canada’s banking systems consistently rank First in the G7 for more than a decade, and it is one of the soundest in the World.

- For quality of life, Canada is ranked in the top 3 countries year after year.

- Toronto is ranked in the top 10 worlds most liveable cities

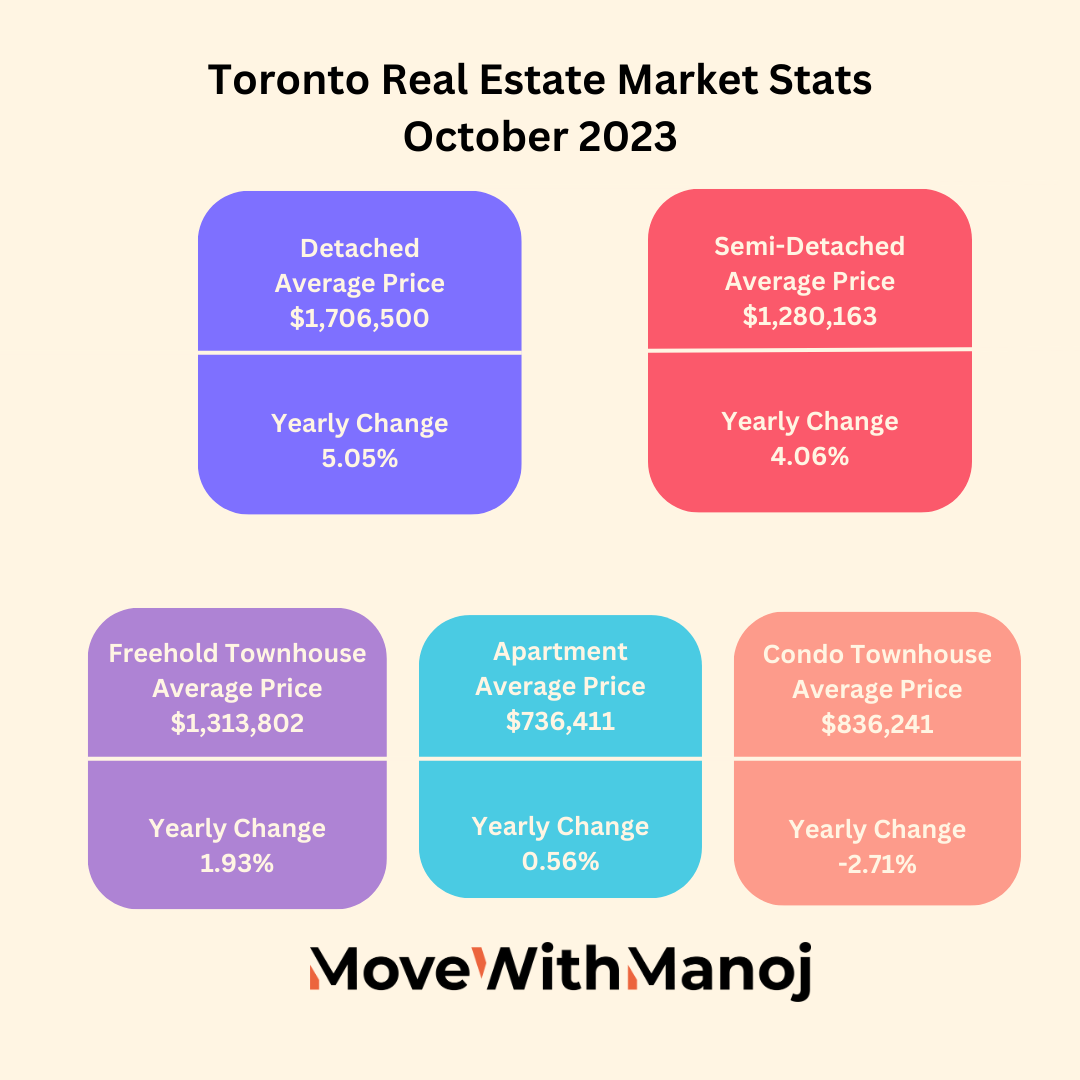

- Toronto Real Estate Market has been a sound investment in the last 20 years and continues to perform well. Click here to see how the market is performing

- Our vacancy rates on rental have roamed around the 1% mark within the last five years

- Toronto is positioned to be the next Tech hub with fortune 500 companies opening their offices here

- Toronto is positioned to be the future NYC in the next ten years

- Favourable Tax policies for Startup’s and a Business-Friendly City

Considering all of the above factors, I think we will attract more immigrants, companies and jobs in Toronto. Which would mean we need an increase in the supply of housing. Unfortunately, we don’t have a lot of land available to build on; that’s why prices are increasing dramatically, and they will continue to grow in the long-term.

There is also a demographic shift to consider when investing in condos. Most people believe that millennials are purchasing or renting them, but there is a high demand from Baby Boomers hitting the market. There are 1.4 million baby boomers across Canada looking to buy a home in the next five years. 56% consider their local housing market unaffordable for retirement, and 32% are most likely going to buy a condo. 45% plan to buy a detached home, and 10% plan to live in a semi or townhome; 5% are considering a recreational property.

What are the benefits of investing in a Condo?

- Less Maintenance as an Owner-Generally, there isn’t much to do in a condo, especially if you purchased a new condo or relatively new. Most of the owners visit there condo once a year to sign a new lease and pick up their cheques. The building management does all of the snow removals, grass cutting and keeping the common areas clean.

- Professional Property Manager in the building- If your building is large enough, there will be a certified property manager. Property managers are responsible for the maintenance and repairs of their buildings and have to ensure that all systems are in working order. They supervise staff, do the paperwork, have the bookkeeping done by their management office, and promptly see that owners pay their condo fees.

- 24-hour Concierge- First responders of any noise complaints or if any other condo bylaws have been broken. The concierge and property manager will help reduce your risk of a bad tenant by letting you know if they are smoking in the unit or breaking any condo bylaws.

- Condo By-laws- Extremely helpful because your tenants will have to follow them; otherwise, the management will help you evict them. Rules with regards to noise, smoking, running a business, etc.

- Peace of Mind- As a condo owner, you have more peace of mind because of all of the above factors.

- Affordability- Priced lower than low rise homes and easier to qualify for a mortgage with 20% down. Generally, they produce a positive cash flow or very little negative cash flow monthly.

- Effortless to Rent out-If you are in the right location, it is effortless to rent it out. You may even get multiple offers to rent. Vacancy rates are in and around 1%

- Appreciated- As discussed in this blog, the appreciation is very attractive as an Investment Vehicle

- Amenities- Attractive amenities can help you resell the condo faster and help you get tenants in faster.

What are the downsides of investing in a Condo?

- Maintenance Fee’s- They tend to go up, just like everything else. The fees you have are split into current expenses and future expenses, which is exceptionally prudent. If you were to purchase a home, do you put aside money monthly for future costs such as the roof, windows, furnace, paint, etc.?. Luckily condo bylaws expect property managers to keep a reserve fund for future expenses. Even though you may have bought a brand new condo, 20 years down the line, it will need a new roof, a condo corporation will plan for those expenses and others. As for current costs, some shared utilities cannot be factored in with a 100% accuracy, only because that depends on the common usage of the whole building. The utility companies keep raising their rates. Hence, the maintenance fees keep rising in Condos.

- Liquidity- meaning if you were to try to sell your condo by the time you receive the money in your hand, it could be 60-90 days.

- Tenants- Do your due diligence when buying and renting out your condo. It is essential to do your homework to understand the demographics in that neighbourhood and the type of tenants you are comfortable dealing with. Most Tenants are fantastic, and they respect their landlords, but there are a few bad apples out there that ruin it for others.

Pro Tip- There are Property Management Companies out there that will take care of all the headaches.

4. Property Managers mishandling funds- There have been stories where condo managers have mishandled funds. The board of directors get extra things done in their place, but that represents a very small portion of the existing condos out there.

5. Special Assessment- Possibility of special assessment charges for unexpected repairs if you purchase an older condo

6. Builder Risk- If you are buying a Pre-Construction Condo, you need to do your due diligence and make sure you are purchasing from a reputable builder with a history of building many buildings. You also need to make sure all of the plans are approved already. Every year we tend to see a few projects get cancelled, and investors lose out on the growth of their money, which can be extremely frustrating.

Condos Vs Stocks?

As an average Canadian, you have a few options when it comes to investing your money. I won’t discuss Guaranteed Investment Certificates (GIC’s), savings accounts, or Bonds because realistically ever since 2008, they are producing negative rates of returns after accounting for taxes and inflation. Like seriously 2% on a $100,000 Investment is roughly what you are getting.

Let’s move on to the Toronto Stock Exchange (TSX), where you can make better returns. If you invested $100,000 in January of 2015 by February of 2020, your $100,000 would have turned into $110,833. That’s right before the crash caused by Covid-19, and the highest point it ever reached was in January 2020, where it was worth $118,025, even if I look at that you would have averaged roughly 3.6% a year.

On the other hand, if you invested in a 1 Bedroom Condo in January of 2015, you would have paid $329,659 for that condo. If you used the same $100,000, that would have been a down payment of 30% for that condo, where the banks would have easily lend you the rest of the money.

Investment Properties work great because you get to use other people's money to make more money for yourself. You can borrow money from the bank to invest in mutual funds or TSX, but they will only lend you 50% to 100% or your investable assets, i.e. $100,000 your money they will give you $50,000 to $100,000. Whereas in real estate, they will only require 20% for investment properties, i.e. 500,000 purchase price, down payment required by you is only $100,000, and they will give you a $400,000 mortgage. Back to our one-bedroom condo where at 30% down, you are probably cash flow positive, but for this example, we won’t use any of that, nor are we going to factor in the reduction in your mortgage over the last five years. As you can see from the chart below, $329,659 condo is worth $626,182 by Feb 2020, which means your original $100,000 has made you $296,523 in profit over the last five years vs $18,000 in the TSX. Even if you factor in real estate commission, lawyer fees and other closing costs to sell this property, you are way ahead of the game by investing in real estate.

If you were wondering what if you purchased a two-bedroom or three-bedroom condo as an investment, I could always pull that information for my clients. Just for this study, we also used the average price increase of a condo. So this is an average of all of the condos sold within a given month in Toronto, it doesn’t matter if they are studio, one bed, two bed, etc. The graph below includes all of them. The average condo price point in Jan 2015 was $384,027, and once again, you could have easily purchased this with a $100,000 down. This is a 26% down payment, that would have resulted in some positive cash flow.

With the power of leverage working in your favour by Feb 2020, your condo would have been worth $730,494. That is a 90% increase in your investment, meaning you would have made roughly 18% per year in 5 years and two months. If you want to be precise, it’s 17.46% for five years.

Why did you choose the TSX vs any other Mutual Fund?

The reason why I choose the TSX is that the goal of every Canadian Mutual Fund is to beat the underlying index, and that happens to be the TSX in Canada. According to a study done by Standard & Poor’s (S&P), 1 out of every 20 mutual funds ends up beating the index over a 15 years. Hence, why I choose the TSX as an underlying investable option.

Comments