Non-Resident Purchasing a Property in Canada

Can a U.S. Citizen buy a Property in Canada?

The short answer is yes, U.S. citizens can buy a property in Canada, and our banks will finance it for you as well if needed. Anyone from any country can buy a property in Canada and get financing for it from our banks. U.S. Citizens' property ownership rules are pretty simple, with a bit of twist from Province to Province in terms of costs. I live and work close to Toronto, so in this article, I will discuss tax implications and the process of buying a property in Ontario.

Why do Americans buy Property in Canada?

- USD vs. CDN- with the current exchange rates being so attractive, your money goes a lot further here

- Toronto is Canada's Economic Driving Force, and Toronto is the second-largest financial center in North America.

- Canada's banking systems consistently rank First in the G7 for more than a decade, and it is one of the soundest in the World.

- Canada ranks in the top 3 countries for the best quality of life every year.

- Toronto ranks in the top 10 world's most liveable cities.

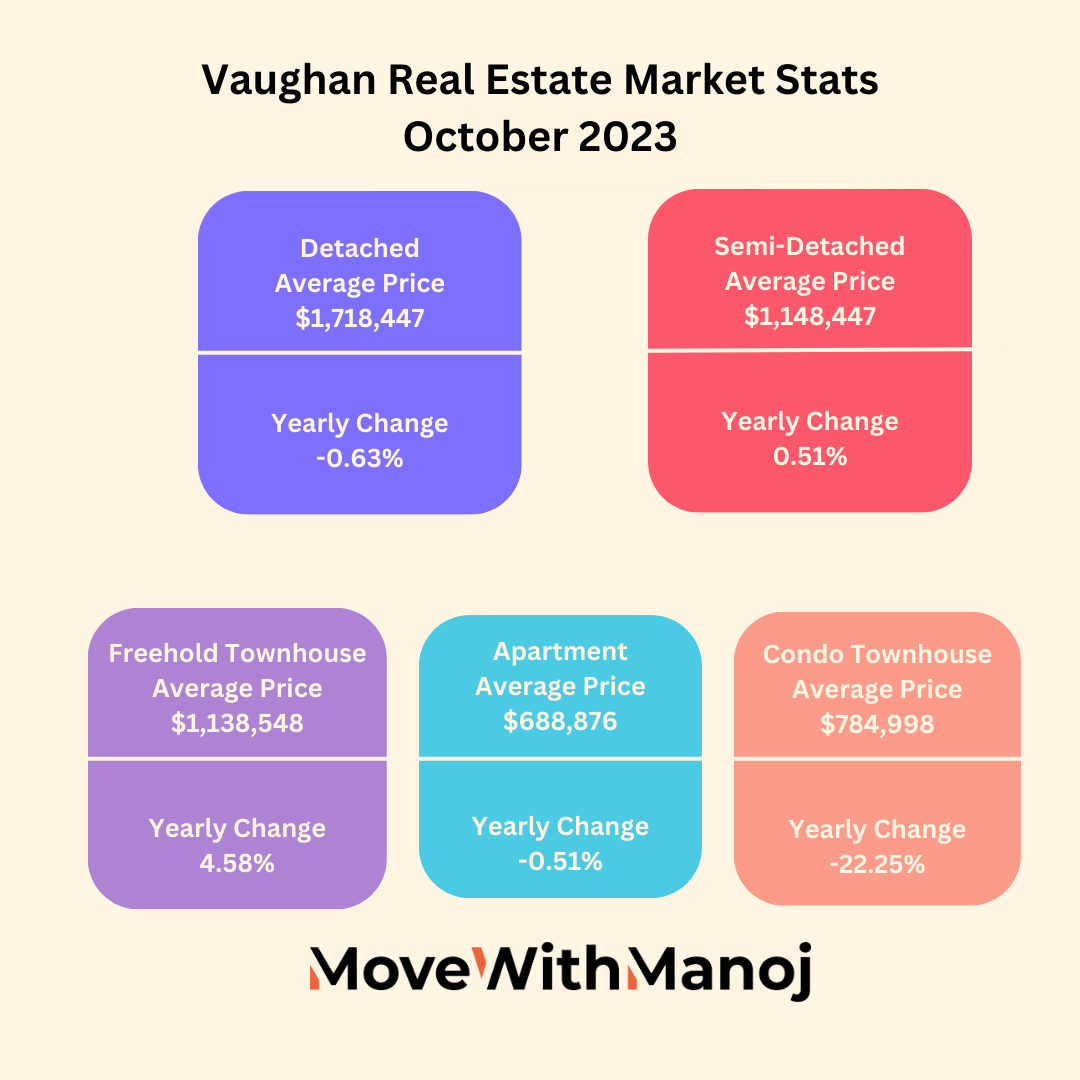

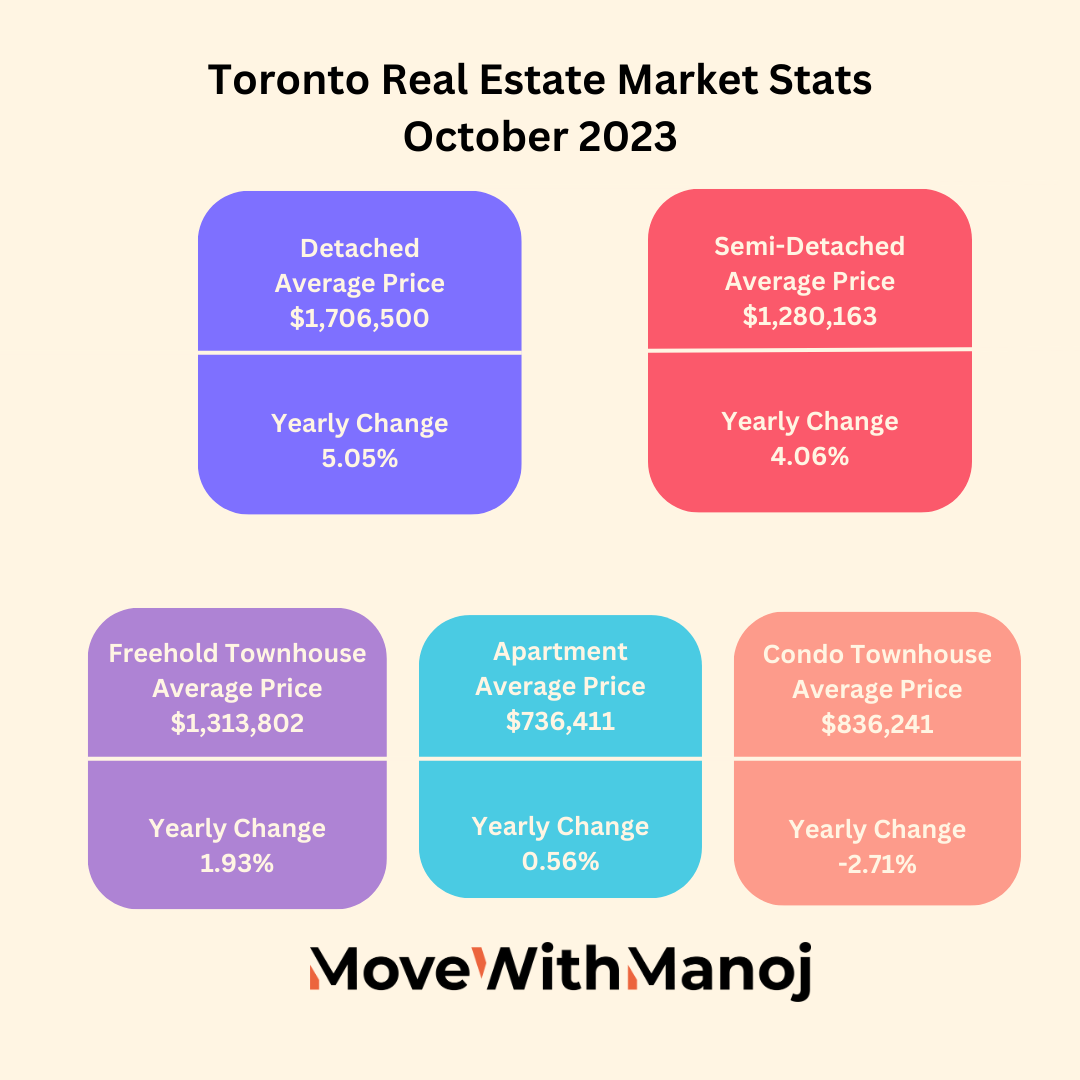

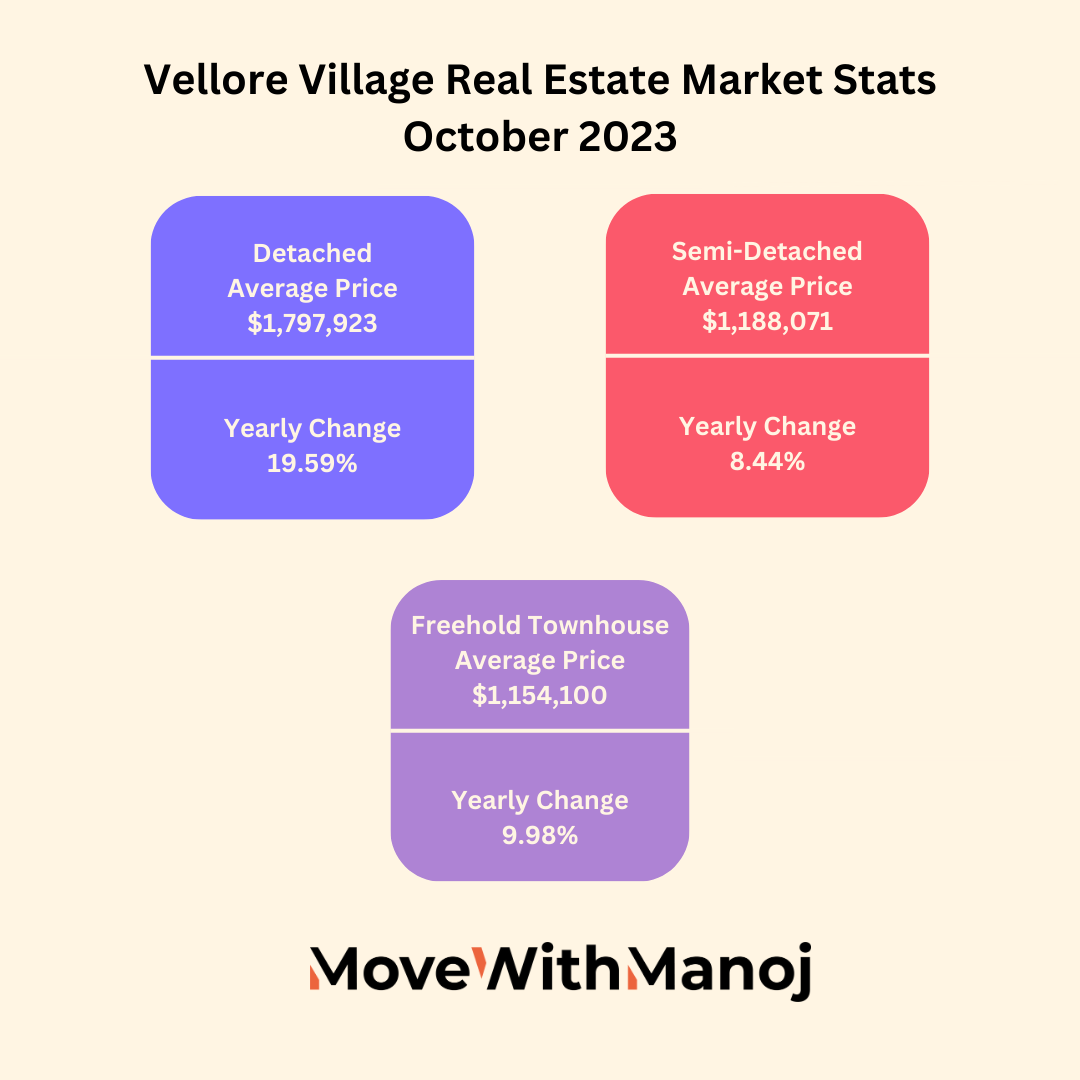

- Toronto Real Estate Market has been a sound investment in the last 20 years and continues to perform well. Click here to see how the market is performing.

- Our vacancy rates on rentals have roamed around the 1% mark within the last five years.

- Toronto will be the next tech hub, with fortune 500 companies opening their offices here.

- Toronto will be the upcoming NYC in the next ten years with the current population and economic growth.

- Astonishing Population growth, click here to see https://www.fin.gov.on.ca/en/economy/demographics/projections/Favorable Tax policies for Startups and a Business-Friendly City.

Can you get a Mortgage?

Yes, you can! The rules around U.S. Citizens buying a property in the banking industry are that you will have to put down 35% of the property's purchase price, and the banks will lend you 65%. Our banks will need to verify your income, your U.S. credit score, the source of funds (which cannot be a gift from another person). I would highly advise you to get a Pre-Approval from a bank before beginning your search for a property. This way, you will know how much the banks will lend you. To get a pre-approval, all you need is the "Application Requirements" listed below, and the "Documentation" requirements can be submitted after you found a property.

To get approved for a Canadian Mortgage, here is what you will need;

Canada

Time to Get an Approval

5-10 Business Days

Application Requirements

- Income

- Assets & Liabilities

- Other Real Estate you own

- Type of property you are buying

- Proof of 2 years employment

Documentation

· Purchase and sale agreement

· Confirmation of down payment

· Proof of employment and income

Down Payment

35% of the Purchase Price

Closing Costs

Generally, about 2.5%, but if you purchase a property within the Greater Golden Horse Shoe in Ontario or Vancouver, there is an extra 15% Non-Resident Speculation Tax added.

Mortgage Interest Rate

Very competitive

What are the closing costs of purchasing a property in Canada?

Below is a list of standard closing costs to expect.

- Property Inspection-depending on the size of a house, an average home will be around $300-$600. For Commercial Properties, it can be $1000-$5000.

- Lawyer Fees- Residential Lawyer $1,000-$2,000 Commercial Lawyer $3,500-$7,000

- Title Insurance-$250

- Land Transfer Tax-depends on the value of the property. It ranges from 1%-2.5%; access our Land Transfer Tax Calculator click here.

- Property Tax Adjustment- The value of the property tax that has been paid in advance for the year.

- HST-generally only for New Homes or Condos

- Non-Resident Speculation Tax- discussed below in detail.

To understand the complete buying process, click on this link.

Foreign Buyers Speculation Tax

The only difference that American property buyers and Canadian Citizens or Permanent Residence have in Ontario is that they will be charged an extra Non-Resident Speculation Tax (NRST), which is 15% on the property's purchase price. The NRST only applies to properties purchased in the Greater Golden Horseshoe Region (GGH); the complete list of the cities and municipalities is listed below. This tax is not only charged to individuals, but it also applies to Foreign corporations (foreign entities) and taxable trustees.

· City of Barrie

· County of Brant

· City of Brantford

· County of Dufferin

· Regional Municipality of Durham

· City of Guelph

· Haldimand County

· Regional Municipality of Halton

· City of Hamilton

· City of Kawartha Lakes

· Regional Municipality of Niagara

· County of Northumberland

· City of Orillia

· Regional Municipality of Peel

· City of Peterborough

· County of Peterborough

· County of Simcoe

· City of Toronto

· Regional Municipality of Waterloo

· County of Wellington, and

· Regional Municipality of York

·

There is still a large portion of Ontario where if you were to purchase a property, this tax would not be imposed on you. If you bought a property in Ottawa, you wouldn't be paying the NRST.

What are the monthly expenses of owning a property?

To see homes currently for sale and market reports, please click here.

Comments