What to Expect At Closing

What to Expect At Closing?

After probably many back-and-forths, the mortgage loan application, endless home showings and negotiations, one would think that buyers finally get to relax when they get their offer accepted. Still, it's more like taking a break before the final step, which is also known as closing. The closing date is when buyers finish the transaction and get handed over the key to their new home. Many of them are excited to finally move in but also nervous about how things will play out and if any unwanted surprises are awaiting them. They have probably heard many stories of delayed moving dates and what could go wrong, but if coming prepared and informed, with everything required to finalize the transaction, nothing much can happen to ruin the day. So, let's see what you can do on your part to protect yourself against any mishaps.

Bring documents: Have all the necessary documents ready, from your ID and the mortgage approval to the property and land survey tax bills. Have your lawyer take a final look at all the papers, including the sales contract to make sure one more time everything is in line.

Title insurance: Having title insurance means protecting oneself against third-party claims or lawsuits regarding property ownership or homeownership. Title insurance will also verify if all mortgages of your predecessor are closed (which they should be by the closing date).

Check outstanding balances: This is something you will have to do in advance to make sure your new home doesn't come with old debts, like unpaid utility bills. The seller should provide you with a final meter reading way before the closing date, reassuring you that all accounts have been taken care of or at least that they will be. Have your realtor ask the sellers or their representative if they have scheduled cancellation of utility, cable and internet services, so you can act quickly if they did as utilities and services won't be rolled over automatically to your name. You will have to call the providers to keep the services running under your name.

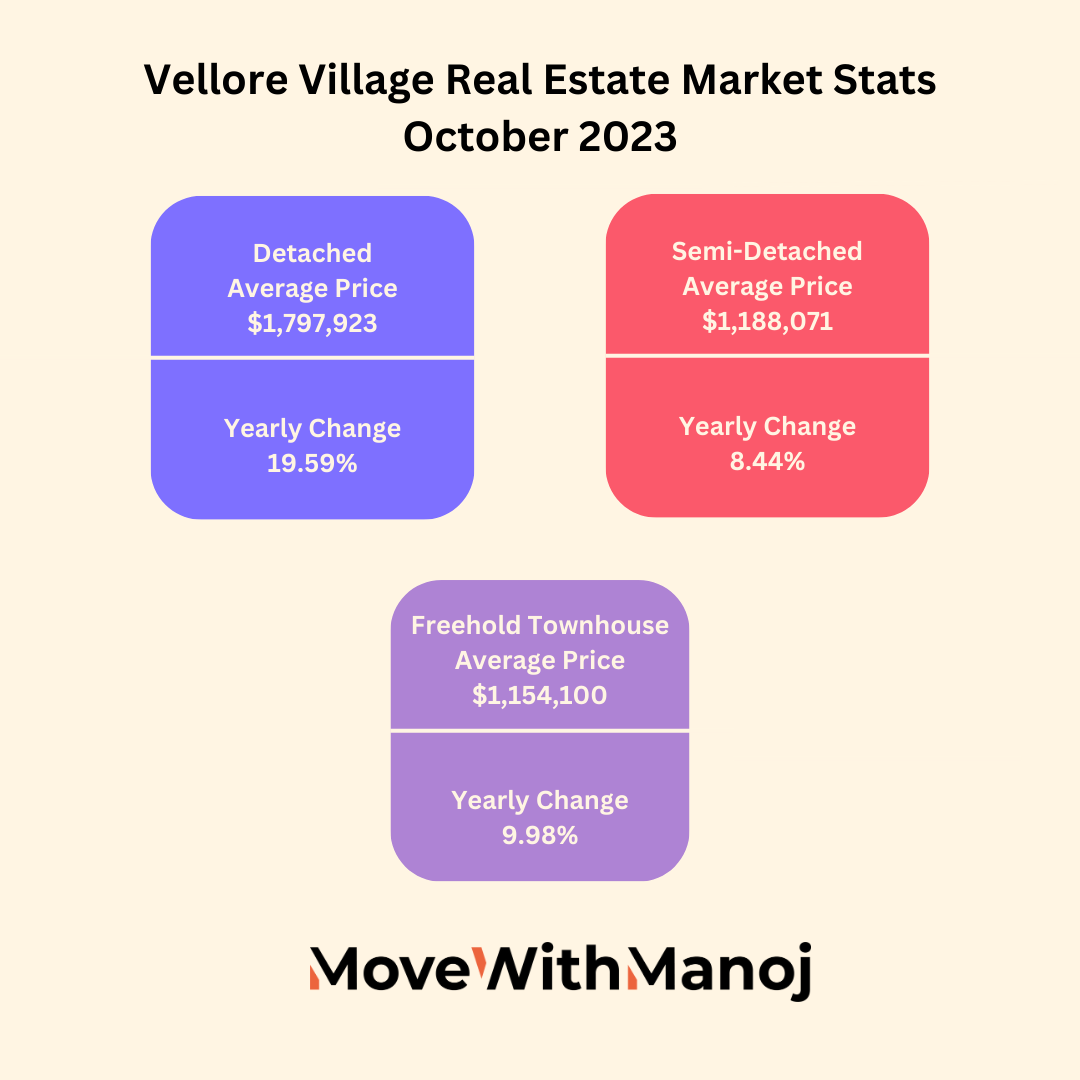

Check out listings in Vaughan here!

Check appliances: All the paperwork can easily have you forget to run a check inside the home, so have your realtor remind you to walk through the home and ensure all appliances are included in the sales contract work. If not, you can immediately complain to the seller in a week, or it might already be too late.

Have the needed funds ready: Closing costs also go by the name hidden costs as buyers are not always sure what else is left to pay besides the mortgage, but closing costs can be up to 1.5-2% of the home's value which means be ready to "splurge "several thousand extra dollars on the closing date to cover the costs of inspection, title registration fees, lawyer fees, homeowner insurance, mortgage processing fees, property appraisal, taxes and any closing adjustments.

Pick the correct date and time. Many real estate agents recommend avoiding the end of the month, especially if it's a Friday. It's usually a busy period for agents and may take the whole day, and if it comes to any delays, you have to wait until Monday to move into the new home finally. On the other hand, the middle of the week is usually a good pick, according to the experiences of others.

Are you thinking about buying a home in the GTA? Call Manoj Kukreja (647) 370 - 0992 or contact him here and ask anything you want to know about buying a home in the GTA.

Comments